Advantages of DINERO

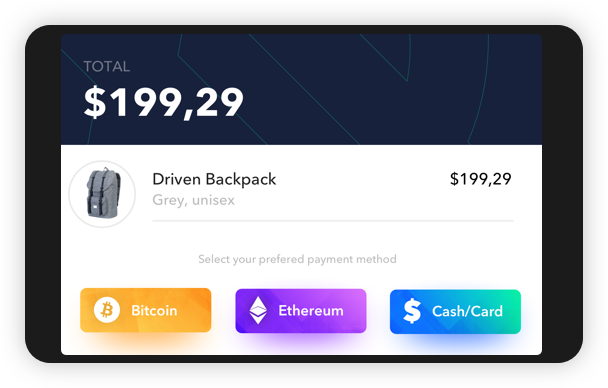

Independent multipurpose solution intended for coffee shops, restaurants, shops, etc. Pay or exchange cryptocurrency in your favorite place with ease.+ Pay with cryptocurrencies:

Dineroone will be enabler of cryptocurrency payments in the real world.

Pay for your coffee or croissant with digital currencies in a simple and safe way.

+ Automatic cash counting:

Forget about counting or worrying about your cash and focus on what matters most to your business.

Dineroone will count cash automatically and report it in real time.

+ ATM everywhere:

Save time by exchanging cryptocurrency for cash just around the corner.

Turning your neighbourhood places into exchanges by creating wide range of independend cryptocurrency ATM’s

+ All-in-One solution:

PC, cash register, POS device and invoicing system — in one device!

Just plug-in your Dineroone, stop worrying and start earning money

1. The platform Dinero One will offer

1.1. Dineroone multipurpose cash drawer with the ability to count money itselfIn order for business owners to avoid the above-described problems, the Dineroone multipurpose cash drawer has the ability to count the money itself as its main task.

Money counting will be automatic, i.e. dynamic and in real-time.

Dineroone will work in such a way that when the drawer is opened, money is placed in it and the cash drawer is closed. It will calculate changes in denominations (coins and banknotes) on its own and display the total balance on the screen (module) that is part of the cash drawer, and on other devices (described below).

Each cash transaction — withdrawing and/or depositing cash from/into the drawer (the drawer opens, the transaction is executed, the drawer closes) will be recorded in a database, which can be accessed through a user-friendly interface. Data recording will help business owners better analyze cash flow, identify potential issues, etc.

1.2. Dineroone with the ability to accept credit-card payments

We are all familiar with payments via debit and credit cards (Amex, Visa, MasterCard, Diners, etc.). It should be noted that business entities that offer this kind of payment lose a portion of their revenue (a fee) for each transaction that is made with such cards and they usually pay fixed monthly fees for using the card-based POS device from the local card providers (most often banks).

With Dineroone, a small portable POS device will come free as an option that will allow card payments with lower fees and the conversion of credit card money into cash or cryptocurrency (currency exchange).

1.3. Dineroone with the ability to accept cryptocurrency payments

The portable POS module (or modules, if more are needed) for card payments will also be used to pay with cryptocurrencies no matter which cryptocurrency is used. Dineroone will be regularly synchronized with all relevant stock exchanges on which those cryptocurrencies are listed, based on which the average value of a cryptocurrency will be obtained, or a single exchange chosen by the business will be used to determine the current value of a cryptocurrency.

Businesses will be able to choose which option they want to use.

Let’s say a user wants to pay for a coffee with the BCH (Bitcoin Cash) cryptocurrency. The café employee will convert the price of the coffee from the local FIAT currency (e.g. €1 + commission) to BCH and display the QR code on our portable POS module. The buyer will scan this QR code with their mobile phone and transfer the converted amount of BCH from their wallet to the business’ wallet, i.e. to the Dineroone multipurpose cash drawer located in the café.

In the same way, a buyer may exchange a certain amount of cryptocurrency into cash (currency exchange).

In this case, with its platform, the Dineroone multipurpose cash drawer has the role of a proxy or mediator between relevant currency exchanges and businesses.

The important thing of this everyday business for both businesses and users (customers) is simplicity, security, and speed of payment. The Dineroone multipurpose cash drawer/platform will generate a wallet address for the business for each new cryptocurrency to be used.

E.g. a customer wants to pay for a coffee with the ABC cryptocurrency, but the business does not have a wallet for that cryptocurrency. The café employee will be able to calculate the value of the coffee from the FIAT currency (plus the commission fee) into the ABC cryptocurrency and Dineroone multipurpose cash drawer/platform will automatically generate a wallet address for the ABC cryptocurrency for the business.

In that way, the Dineroone multipurpose cash drawer/platform will become a centralized place for storing various cryptocurrencies (a multi-wallet). Businesses will not have to worry about creating a wallet address. We will take care of that, and businesses can then decide whether they want to keep cryptocurrencies on the generated wallet or transfer them to a different one (to their personal wallet, to the exchange, etc.).

1.4. Dineroone multipurpose cash drawer/platform will offer a currency exchange service (ATM)

A) Conversion of credit card currency into cash

E.g. a customer in a restaurant asks for €200 (local FIAT currency) of cash, and offers his VISA card as the basis for exchange. Through our portable POS module, the restaurant employee charges the user’s card for €200 + a commission fee (e.g. 6%, i.e. €212), withdraws the amount from the customer’s account connected to the VISA card, and gives the customer €200 in cash.

B) Conversion of credit card cash into cryptocurrency

A customer wants to buy a certain amount of cryptocurrency (e.g. DNRO cryptocurrency, or any other) in the equivalent FIAT currency (e.g. €100), but is not registered on the stock exchange that trades with that cryptocurrency or is unable to make a payment with a credit card to purchase that cryptocurrency. The customer goes to a business (e.g. a newsstand) that uses DineroONE, and the newsstand employee charges him €100 + commission (e.g. 7%, i.e. €107) from the account connected to the card, and transfers the DNRO (or any other) cryptocurrency in the value of €100 to user’s wallet address.

The employee first calculated how much DNRO cryptocurrency could be purchased for €100 (e.g. 500 DNRO tokens) and, after receiving a €107 EUR (100 EUR + 7% commission) payment from the user’s credit card, the employee buys 500 DNRO tokens that are automatically transferred to the business’ (newsstand’s) wallet. After that, using the portable POS module, he scanned the QR wallet address on the user’s mobile phone and transferred 500 DNRO coins to him.

C) Conversion of cash into cryptocurrency

Same as under B) only in this case the user pays with cash.

D) Conversion of cryptocurrency into cash

E.g. A customer in a store asks for €500 of cash and offers an equivalent value in the ABC cryptocurrency (e.g. 5,000 ABC coins). On the portable POS module, the employee selects €500 as the output value and ABC cryptocurrency as the payment method. The required amount of that cryptocurrency (5,000 Coins + commission) is printed at the entry value for payment. A portable POS module generates a QR code payment for the customer to scan with their mobile phone and sends 5,500 ABC coins (500 ABC coins are commission) to the store’s wallet. After the transaction is confirmed by the employee, he gives €500 cash to the customer.

E) Conversion of cryptocurrency into another cryptocurrency

E.g. A customer wants to buy 200 XYZ coins with ABC coins in a bakery that uses the Dineroone multipurpose cash drawer/platform. On the portable POS module, the employee selects XYZ coins for output value, ABC coins as the payment method, and the required amount of that cryptocurrency with the commission included (e.g. 450 ABC coins + 45 ABC of commission) is entered under the input value. On the portable POS module, the QR code for the payment is generated, and the user scans the QR code with his mobile phone and sends 495 ABC coins to the bakery’s wallet address. After the transaction has been confirmed, (the drawer will sound an alarm for a confirmed transaction), the bakery’s employee sends 200 XYZ coins to the customer’s wallet address by scanning the QR code from the customer’s mobile phone with the portable POS module.

1.5. Dineroone with the ability to offer all-in-one hardware and software solution.

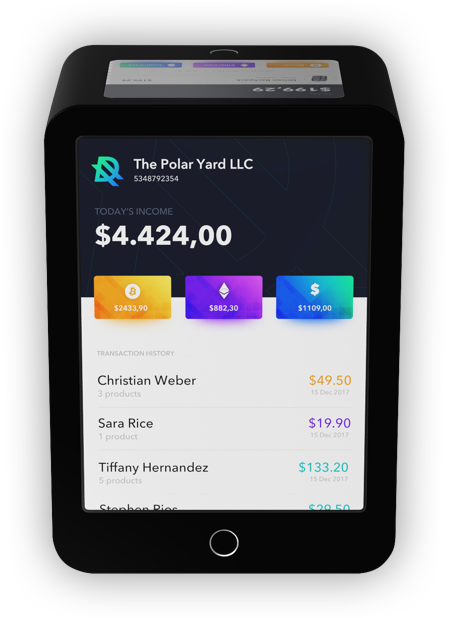

One part, or a Dineroone module, will also feature a large screen on top of the drawer (a touch-screen computer/tablet) so that business owners will have everything they need as part of the Dineroone multiverse cash drawer/platform.

They will be able to use our software for their business (the software will be universal, but customized in terms of legal regulations for each individual market) or install the appropriate operating system and use it on the Dineroone multipurpose cash drawer/platform.

Our platform will display the current balance of cash in the Dineroone multipurpose cash drawer/platform, the total balance and denomination per coin and banknote, the value of the cash in the DINERO (DNRO) cryptocurrency at the given exchange rate and the individual value of the DINERO (DNRO) cryptocurrency. The balance of the cryptocurrency and credit card transactions and their equivalents in DINERO (DNRO) cryptocurrency will also be displayed.

Along with the services offered by the Dineroone multipurpose cash drawer/platform, all of these figures will also be displayed in real-time for business owners via smartphone apps and the PC.

In order for users to know that a business offers these options, Dineroone will also come with stickers that they can stick on a visible location (e.g. on the entrance door), just like with credit card company stickers. We will also offer other promotional material, which will be present in businesses for informing users.

2. BUSINESS MODEL

2.1. Selling the Dineroone multiverse drawerOnce the Dineroone multipurpose cash drawer is commercially available, the main goal is to distribute (sell) it to businesses. This is an obvious step; a classic sale with the aim of increasing the profit margin.

The distribution of the Dineroone multipurpose cash drawer is the key for creating a network of points of sale that accept all the features they offer (automatic cash counting, various payment methods, currency exchange, etc.).

2.2. Commission from credit card and cryptocurrency transactions

A) Credit/Debit cards

With credit card payments, businesses are charged credit card fees for every transaction. For example, if a product costs €100, the customer paying with a credit card is billed €100. But the business will receive this amount with the payment gateway fee deducted. This fee is e.g. 4%.

The goal is to offer businesses a lower fee for credit card transactions (e.g. 2.95%) so that they are benefited by using our payment gateway. Part of the 2.95% commission goes to us and the Investors — Token holders as our income (in equal amounts).

Payment gateways are a well-established business model, which do not require any additional explanation. Some of the service providers include: Squareup, Izettle, Cloverconnect…

B) Cryptocurrencies

With cryptocurrency payments and exchange services, part of the revenue (fee) will also go to us. When someone pays for a service with cryptocurrency (e.g. lunch at a restaurant), the converted amount of the FIAT currency to cryptocurrency will be increased by the amount of the defined fee (e.g. 7%). This 7% will be divided amongst four entities:

+ Part of the commission will go to miners to confirm transactions (for currencies that demand it, e.g. ETH)

+ Part of the commission will go to businesses as motivation to continue accepting cryptocurrencies as a means of payment

+ Part of the commission will go to Investors — Token holders

+ Part of the commission will go to us

Roughly speaking, most of the 7% commission goes to the businesses (e.g. 4.5%), to miners (e.g. 1.5%) and the smallest part to Investors — Token holders (e.g. 0.5%) and to us (0.5%).

The same principle applies to the exchange service fees.

The exact amounts of all commissions will be defined at a later stage and will be acceptable for all those involved.

The primary purpose of our payment gateway will be for offline businesses (as part of the Dineroone multipurpose cash drawer), but the cryptocurrency and card payment gateway will also be available to online business entities (e.g. web shops). A solution similar to the one offered by Coss.io.

2.3. Billing Software (Application)

An additional option that will be available to Dineroone multipurpose cash drawer owners is the use of our software for issuing receipts and everyday work. Our software will be integrated into the drawer. It will be placed on the touch screen located on top of the drawer and will be customized individually for each market. Along with the standalone software, there will also be API capabilities — APIs will be able to connect our software with the software the business already uses. In that way, businesses will be able to use our front-end software interface (which will be more advanced and simpler — emphasis on UX) and all the data will be stored in their existing software (back-end).

An additional option is the ability to remotely track all transactions (cash, cryptocurrencies, credit cards) with the Dineroone multipurpose cash drawer using software installed on their remote computer or smartphone. With our remote application, at any given time, business owners will be able to know how much cash is in the drawer, how many cryptocurrency and credit card transactions were completed, how many exchanges there were, the equivalent of all transactions in DINERO (DNRO) cryptocurrency, the individual value of the DINERO (DNRO), etc.

The main software, API software, and remote software will be available to customers with a payment of symbolic monthly fees — e.g. €0.99 EUR per month for remote software, €9.99 EUR per month for

the main software, €4.99 EUR per month for API (front-end), etc. Precise fees will defined at a later date.

3. MARKETING AND MONETIZATION

Following the development of the Dineroone multipurpose cash drawer/platform, marketing preparation for product launch and customer prospecting will be done.This is a standard business procedure, setting up partnerships and negotiating with customers (emphasis will be placed on customers ordering large quantities of drawers), even before the product is completed. Marketing activity will be present throughout the development phase of the Dineroone multipurpose cash drawer/platform, especially after the product is ready for monetization, in order to increase sales.

Marketing has always been essential for a product’s success, especially today, when we have everything in excess and when it is harder than ever to get the customer’s attention.

Given the uniqueness and innovation of our future product — the Dineroone multipurpose cash drawer and platform, with YOUR help, and top development, sales, and marketing experts (with a special emphasis on digital channels), we do not doubt our success for a single minute!

Project investors will receive a certain amount of DINERO (DNRO) Tokens in accordance with their investment (described above in the “PHASE 1” section). After the successful crowdsale, Dinero (DNRO) will be listed on the relevant stock exchanges to enable trading.

DINERO (DNRO) is an Equity Token that will enable investors (DNRO Token holders) to receive a constant influx of revenue generated by (cryptocurrency and credit card) transactions in the form of Dinero Token transaction payments that will be paid once a month.

The plan is, amongst other things, to brand DNRO cryptocurrency, through constant presence on the Dineroone multiverse cash drawer/platform and remote apps, to raise demand, and, in the long run, constantly increase the price and thus create added value for our Investors.

Investors in this project become shareholders of a new company, which will produce and sell the Dineroone multipurpose cash drawer/platform and offer the services described in this document.

30% of the annual profit generated by sales of the DineroONE multipurpose cash drawer/platform and cryptocurrency and credit card transactions belongs to the Investors (DNRO Token holders).

Profit sharing will take place once a year, for the previous year, in the form of a Dinero Token transaction payment.

The largest investor from a certain market (country) has the right to become the exclusive importer,i.e. distributor for their market, if they wish to do so and in accordance with the mutually agreed-upon terms of cooperation.

E.g., three investors from Sweden have invested in this project. Investor A invested 1 EUR, investor B invested 2 EUR, and investor C invested 3 EUR. Investor C has the right to become the exclusive distributor for Sweden.

4. DINERO TOKEN CROWDSALE

The DINERO Token (DNRO) will be an Equity Token that is completely ERC20 compatible. A total of 350 million DNRO Tokens will be generated for the Token crowdsale phase, and investments in this project can be made with BTC (Bitcoin) and ETH (Ethereum).+ Token Presale Period 01.03.2018–07.03.2018 [1 week] Postponed…

+ Token Crowdsale Period 01.04.2018–12.05.2018 [6 weeks] Postponed…

+ Token Name Dinero

+ Token Symbol DNRO

+ Token Standard ERC-20

+ Tokens Generated 350.000.000 [Unsold/Unused Tokens will be burned]

+ Token Distribution After Token Crowdsale (Presale and Crowdsale Tokens)

+ Presale Exchange Rate 1 DNRO = 0,100 EUR

+ Crowdsale Exchange Rate 1 DNRO = 0,153 EUR [W1] | 0,166 EUR [W2] | 0,173 EUR [W3] | 0,181 EUR [W4] | 0,190 EUR [W5] | 0,200 EUR [W6]

+ Token Investment ETH, BTC

+ Minimum Investment 0,1 ETH | 0,01 BTC

+ Presale Hard Cap € 2 million

+ Total Soft Cap € 18 million

+ Total Optimal Cap € 25 million

+ Total Hard Cap € 45 million

+ Previus Funding €1 million invested (local Investors)

+ KYC Necessary

+ Decision rights Yes, Veto and Voting rights in important decisions

350 million DNRO Tokens will be distributed in the following way:

+ 297,5 million (85%) is reserved for Token Holders (Investors);

+ 17,5 million (5%) is reserved for the future company (stimulation for fast growth, partnerships, etc.);

+ 10,5 million (3%) is reserved for the Team and Founders;

+ 7 million (2%) is reserved for Advisors;

+ 17,5 million (5%) is reserved for bounty program.

Dinero Token Presale is scheduled for March 1st with a hard cap of €2 million or 7 days period, whichever comes first. Exclusive presale price of DNRO is 0.1 EUR.

The DNRO Token crowdsale phase will start on April 1st and will be opened for a total of 42 days (6 weeks) after the launch.

For each investment in the equivalent of one (1) EUR, five (5) DNRO Tokens will be issued plus a potential bonus.

+ An investor invested 1 ETH (Ethereum), during which the value of one ETH was 500 EUR. The investor will be entitled to 2,500 DNRO Tokens plus the potential bonus.

+ An investor invested 0.1 BTC (Bitcoin), and at the time of investing the value of 1 BTC was 10000 EUR. The total value of the investment is therefore 1000 EUR, so the investor is entitled to 5000 DNRO Tokens plus the potential bonus.

Bonus

+ A 30% bonus will be allocated to Investors in the first week of the Token crowdsale phase;

+ A 20% bonus will be allocated to Investors in the second week of the Token crowdsale phase;

+ A 15% bonus will be allocated to Investors in the third week of the Token crowdsale phase;

+ A 10% bonus will be allocated to Investors in the fourth week of the Token crowdsale phase;

+ A 5% bonus will be allocated to Investors in the fifth week of the Token crowdsale phase;

+ A 0% bonus will be allocated to Investors in the sixth and last week of the Token crowdsale phase.

No other bonuses of any kind or nature will be offered afterwards. However, we reserve the right to offer bonuses of up to 40% to selected participants (blockchain hedge funds) through direct invitations and at our discretion.

All Investors will receive DNRO Tokens, as well as all the appropriate instructions, after the successful completion of the Token crowdsale phase.

DNRO Token reserved for the Team and Founders will be frozen (via special Smart Contract) until the Dineroone goes officially on sale.

Upon finishing the successful DNRO Token crowdsale phase, the potential remainder of DNRO Tokens (including bounty campaigns) will be destroyed. E.g. 209 million DNRO Tokens were distributed and 106 million Tokens remain (97.5 million reserved for investors and 8.5 million bounty Tokens). Those 106 million DNRO Tokens will be destroyed.

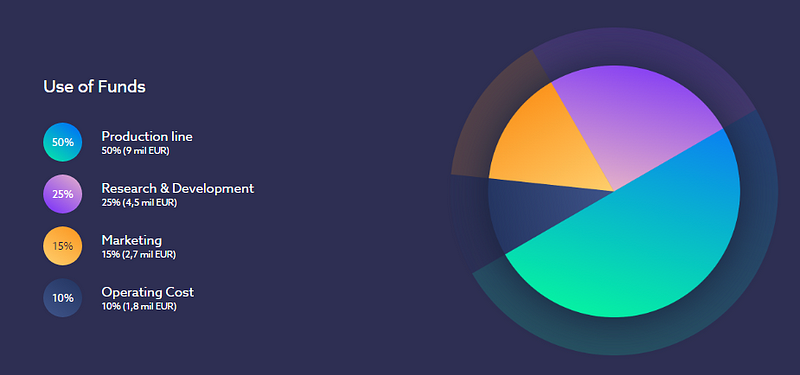

The DNRO Token crowdsale phase will be considered successful if it has collected at least €18 million (SOFT CAP). This is the minimum amount required to develop Dineroone, set up an optimal production line, and obtain the necessary components for the first shipment, prospecting, and marketing. The expected product presentation (sales launch) is ~Q2/2020.

If the DNRO Token crowdsale phase is unsuccessful (if less than €18 million is collected), all the collected funds will be returned to the investors.

The optimum amount (OPTIMAL CAP) of the Token crowdsale phase is €25 million. Investment at this level allows us to develop DineroONE faster (the expected launch is ~Q3/2019) and set up a large capacity production line.

The maximum amount of investment (HARD CAP) is set at €45 million.

An investment of this size isn’t necessary to make the crowdfunding phase successful and to achieve this project, but additional funds would allow us to develop the Dineroone multipurpose cash drawer/platform sooner. The limit has also been set due to the potential participation of large blockchain (hedge) funds and other businesses whose primary purpose is currency trading (input = A, output= A * X) and profit through co-ownership in company.

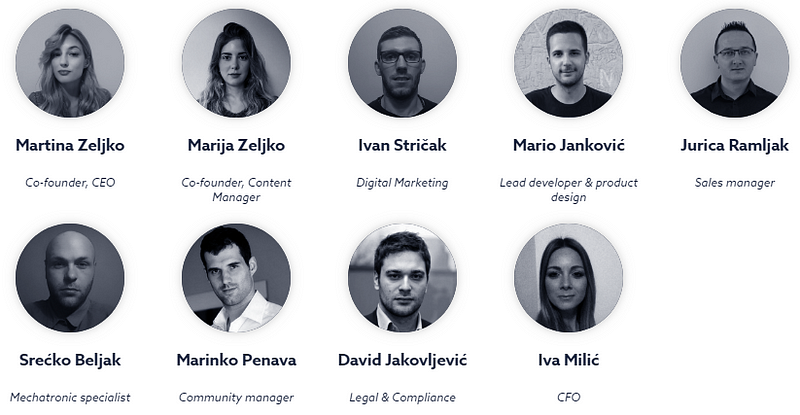

5. Team

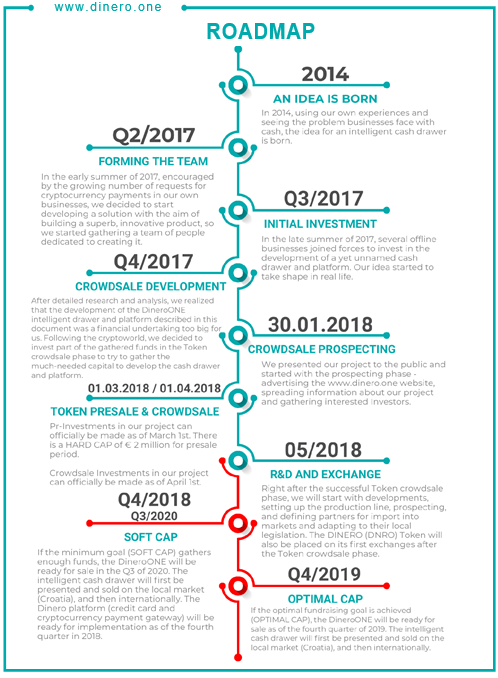

6. Roadmap

More Infomation

Website: https://www.dinero.one/Whitepage: https://www.dinero.one/static/whitepaper/dinero_one_whitepaper_en.pdf

Facebook: https://www.facebook.com/dinero.one/

Twitter: https://twitter.com/one_dinero

Telegram: https://www.facebook.com/dinero.one/

Author

Bitcontalk: https://bitcointalk.org/index.php?action=profile;u=1330327My ETH: 0xC3AF64F15C4a5D6772C320B2D523b889878ba145